- Key Aspects & Importance of Hospital Cash

- Treatments Not Covered under Hospital Daily Cash

- Reimbursement Claim Settlement Procedure

Simran is an insurance expert with more than 4 years of experience in the industry. An expert with previous experience in BFSI, Ed-tech, and insurance, she proactively helps her readers stay on par with all the latest Insurance industry developments.

Reviewed By:

Anchita has over 6 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Updated on Aug 13, 2024 3 min read

Hospital Cash Insurance

Daily Hospital Cash provides a certain amount of money for each day during the hospitalization. The amount paid is fixed at the moment of purchase and does not change.

For Instance - If you are hospitalized and have a plan that pays Hospital Daily Cash of 1,000 INR each day of hospitalization, it makes no difference whether you spend INR 1200 or INR 800 on other medical expenditures. The Insurer will pay a fixed benefit amount of INR 1000 for each day of your admission to the hospital.

Even if per day hospitalization expenses are lesser than Hospital cash, the Insurer would still pay the fixed amount of money, without any kind of questions or restrictions.

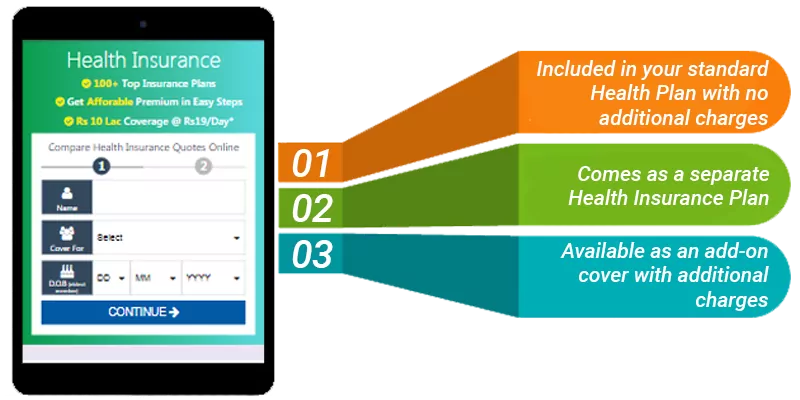

Availability under Health Plan

Are There Any Conditions in The Plan?

Hospital Daily Cash also comes as a separate Health Insurance Plan. Here are some conditions under such plans:

- Waiting Period clause for a shorter period of time than usual

- Hospitalization must last at least 24 hours

- Daycare Treatment is not covered

- Maximum limit on the number of hospitalization days for which the allowance is payable in a year is 30, 60, or 90 days

Features of Hospital Daily Cash Policy

1

Daily Cash Option

250 INR to 8,000 INR

2

Policy Tenure

1 to 3 years

3

Max. Benefit Period

15/30/60/90/180 days per Year

4

PED Waiting Period

24 months to 48 months

Benefits of Hospital Daily Cash

Hospital Daily Cash offers various benefits such as:

Coverage for Inadmissible/ Uncovered Expenses

During hospitalization, Insurers do not cover certain expenses which are coined as Inadmissible Expenses, for example- expenses incurred on Diagnostic tests, Surgical Accessories, or costs of the patient’s attendant.

Irrespective of these inclusions & exclusions, the Insurance Company pays Hospital Daily Cash to the policyholder. It can be used to cover hospitalization costs as well as other Incidental expenses such as traveling costs, household bills, food expenses, and the cost of attendant’s transportation. You can utilize the money to cover the costs which are otherwise not covered under a standard Health Plan.

Coverage for Attendant’s Expenses

Usually, there is an attendant (family member, relative, spouse, etc) who takes care of the patient. Miscellaneous/ Incidental expenses like transportation cost, food expenses of the attendant, etc also financially burden the pockets. With the help of the Hospital Daily Cash amount, the policyholder & family have the liberty to spend the money wherever it is required.

All in all, Hospital cash helps to pay for incidental expenses which are incurred during the treatment.

Avail No Claim Bonus

The Hospital Daily Cash amount can be utilized to pay small hospital bills for minor ailments or procedures.

For example, Mr. Rajesh was admitted in the hospital for 2-3 days for a minor illness, for which, the hospital bill was not so huge. He paid the bill with his Hospital Daily Cash amount rather than filing a claim underHealth Insurance.

Hospital Daily Cash assists you in paying off your medical expenses, prevents filing a claim under your Health Insurance Policy and allows you to preserveNo-Claim Bonus.

Convalescence Benefit

If you are hospitalized for a minimum of 10 consecutive days due to an injury or illness, a Sum Amount is paid once during each policy year. This amount varies from Insurer to Insurer.

For instance - You are hospitalized for a few weeks and you won't be able to work during that time, which could result in a loss of income. The Convalescence Benefit partially compensates for this loss of income by providing a lump-sum payment.

Major Exclusions in Hospital Daily Cash

Any claim caused by, based on, arising out of or attributable to any of the following:

- Eyesight due to refractive error

- Dental Treatment

- Maternity Treatment

- Change of Gender

- Self Injury or Suicide attempt

- Hazardous or Adventurous Sports

- Gestational Surrogacy

- Sleep disorder, Parkinson and Alzheimer

- Nuclear, chemical, or biological attacks or weapons

- Treatment of Alcoholism & Drugs

Claim Process

Only Reimbursement option is available for filing a claim under Daily Hospital Cash. Reimbursement means payment at a later stage. Primarily, you have to pay the hospital bills on your own and get them reimbursed/ settled later from the Health Insurance Company.

Below are the steps that you have to follow to file a claim for your Reimbursement:

Claim Intimation

Notify the company in writing within 48 hours after hospitalization in the case of an emergency, and 48 hours before hospitalization in the case of planned hospitalization.

Document Submission

Provide the necessary documents within 15 to 30 days of discharge from the hospital, one who is filing the claim must provide the necessary documents to the company.

Other Documents

One who is claiming on your behalf must notify the company in writing and submit a copy of the post-mortem report (if any) within 30 days of death.

Required Documents

Following documents are required forClaim Settlement Process:

- Claim form signed by the Insured

- Copy of the Discharge Summary or Discharge Certificate

- Copy of Hospital Bills

- A copy of your ID card (Aadhaar Card, PAN Card, or any other government photo ID).

Consult for Personalized Insurance Advice

But how does it work?

Schedule a call with India’s number 1 trusted advisor with a 4.5+ rating on Google. We are not your average insurance agents. Our advisors are experts in their insurance knowledge and will give you the right information at the right time. The service is free of cost! Don’t worry, we won’t spam as we value your time.

Health Insurer Network Hospitals

Hospital Cash Insurance : FAQs

1. Can I claim both Health Insurance and Hospital Daily Cash Insurance for the same hospitalization?

Yes, you can claim both at the same time. Health Insurance will pay for the expenses covered under the policy and the other will give you a fixed amount on a daily basis

2. Is the policy of Daily Cash Benefit applicable for maternity and childbirth?

It depends on the policy you have purchased for yourself & your family. Therefore, it is important to make it clear during the time of buying the policy.

3. Can I avail Hospital Daily Cash if the policyholder is admitted in ICU?

In circumstances where the policyholder is admitted in ICU, he/she needs to pay larger expenses, and hence, the policy also offers higher coverage. Daily Hospital Cash becomes double when an ICU hospitalization is involved.

Health Insurance Companies

Know More About Health Insurance Companies

Share your Valuable Feedback

4.4

Rated by 2627 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Kaur Vij

Simran is an insurance expert with more than 4 years of experience in the industry. An expert with previous experience in BFSI, Ed-tech, and insurance, she proactively helps her readers stay on par with all the latest Insurance industry developments.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

Do you have any thoughts you’d like to share?